It’s been a couple of months since my last blog.

I’m a little less wise than I was since I last wrote something here, as I followed through upon my wisdom teeth surgery referenced in my last blog.

Thankfully, I store most of my wisdom elsewhere from my teeth, so no need to worry: I’m still a wiseass.

Part of what got me to write that previous blog, and this one, is the amount stuff costs.

I’ll forever be pissed about how much it cost for me to get my wisdom teeth removed, however, I’ve recently had a financial awakening and I wanted to write about that today.

While the wisdom tooth blog wasn’t the only one that mentioned finances, I have to wind the clocks back a little bit for this one.

As referenced in another blog of mine, I’ve recently moved out on my own for the first time ever. This came after the better part of the year living back at my parents’ house and attacking my credit card debt a little bit at a time.

Once I became credit debt-free, it didn’t take long for me to find my own place and get to where I am right now.

However, the fear of money still remained. Despite being a little wiser about when and where to spend my debit, my credit, and my savings, I still had this crippling fear of ending up back underneath the water.

This goes beyond my credit card debt, student debt, and more. This was a crippling fear. A fear that would make the toughest of folks stand still in its presence.

Allow me to dig into this a little deeper…

As an Irish Catholic, there are a few things about life that aren’t necessarily guarantees, but more likely than not if we share the same background:

- Beer is great every day that ends in “Y” and twice on Sunday.

- We’ll sing every song loudly and proudly whether we’re talented or not (or even know the lyrics).

- Soda bread always tastes better than it looks.

- Talking about money is like talking about Satan, just don’t do it.

The fourth one will obviously be the one I focus on today, but I can return to soda bread too if you’re ever curious in the future.

When I was growing up, I truly had the best childhood anyone could’ve asked for. Despite growing up with 4 siblings, I never had a bad Christmas or birthday in my life. Nor did any of my siblings.

My parents took care of us. Made sure we learned life’s many lessons, but also made sure home was always open to us. We never saw them struggle, nor say they couldn’t do something.

We went to Disney World. We constantly took road trips. We went to movies. We went to baseball games. All without any sign of trouble. If there was ever a time where we couldn’t have something, we always valued what we had at home instead.

There are signs looking back now that probably reveal my parents being better actors than putting on from my aged context clues:

One for sure is my mom getting a retail job right after the 2008 financial crisis. We just saw it as, mom got a new job.

Once I went to college and started having to pay a little closer attention to my own finances, I saw my mom stress over the amount of money the loans were going to cost me in the future to attend college in the present.

She ensured me that it would be possible to pay these loans off one day, but needed to make sure that I was sure about school and that I was sure about what I wanted to do. Thankfully for you, I stuck to writing and graduated:

On the other side of college, my loans all of a sudden became a real thing. I didn’t know what to do or where to begin. My mom would get so stressed about them and money any time I asked.

No fault to her, she’s an Irish Catholic woman with 5 kids. We have generational anxiety from that damned devil and his dollars.

Because money was something we never thought we had to worry about, it was something I never did worry about.

And I don’t mean we had Hawaiian Punch fountains or butlers, we just had so much fun all the time we never stopped to wonder how my parents got by.

They didn’t want us to see them struggle. As an adult now, I completely understand this.

Nobody wants to struggle and if they had to, nobody wants anyone to see them struggling.

Which is why when it was time to get a credit card and begin to pay off my loans, I wasn’t fully prepared for what was next.

I got too used to having fun all the time.

Money isn’t always equated to value. I don’t regret any ballgame I’ve been to, vacation I’ve been on, nor nights out at the bar with my friends (ok, maybe a few of those I would take back).

There’s life-value in those types of things. Life is meant to be enjoyed with the people you care about and I always make sure to have fun where I can and if I have to eat soup for a week or two to afford something, I will.

Unfortunately, money is required to do stuff in our society.

So when all the stuff I do for fun ran into a not very money-knowledgeable brain of mine, I caved. I felt like I failed. The only things in my mind were fine-dining and breathing:

All of that was because of this fear of money. I didn’t know how to approach my parents on the subject and didn’t want to bring it to my friends.

How could I? It is the devil after all.

However, the devil must be dealt with at some point in time. But I had to be prepared to fight this devil by becoming fear itself:

Well, no. I didn’t become Batman. But, I began learning discipline and I learned it from one of my friends whose literal job is to help people not be afraid of what strikes fear into all of us.

Jackson Fleming is one of my best friends. He married another one of my best friends and is the best Fortnite squad mate a guy could ask for.

Jackson and I never really discussed our professional duties beyond whether or not work sucked that day or not.

He is a financial advisor and is trained to become a pro at fighting the devil and his dollars. When he discovered how much it killed me to be piled under debt and to move back home, but even more so when I had recovered from that debt and still feared money, he jumped in to help me conquer that fear.

During a 20-minute phone call that also included a couple dick jokes here and there, Jackson simply turned my fear into confidence.

We have a plan for my retirement. We have a plan for when I can buy a house. I have a legitimate spending budget. I have a plan to attack the remainder of my student loans. I have confidence in myself.

Could I have sought out this help at any time before this? Of course I could have.

I didn’t know how to because my parents didn’t know how to. I also didn’t know how to because schools don’t teach it unless you study what Jackson wanted to study.

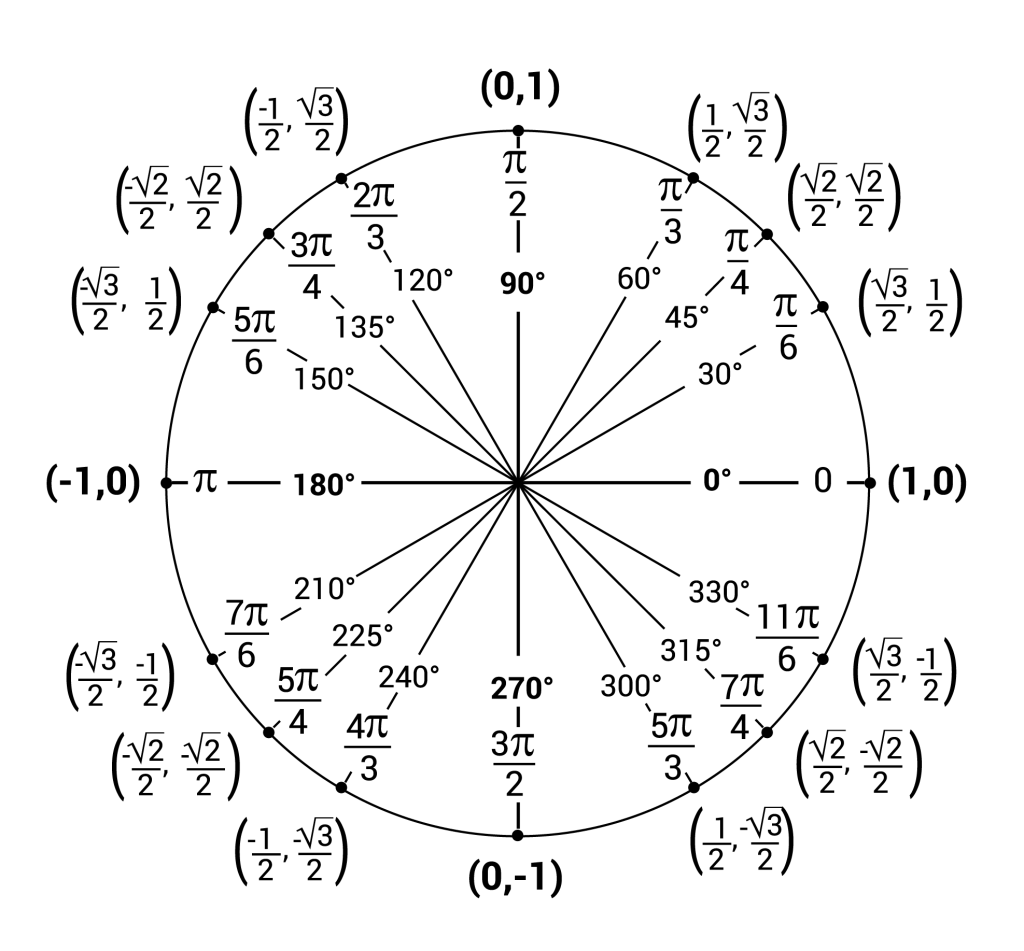

I could go down a rabbit hole about how I wish I learned more about finances in high school than the fuckin’ Unit Circle, but I digress.

TRIGONOMETRY TRIGGER WARNING:

I’ll never have Bruce Wayne’s finances. I’ll never have the Bat-Credit Card:

But what I do have now is no fear. But no fear doesn’t mean fearless. Fears exist to constantly be conquered, but you can’t forget where fear got you in the first place.

You have the resources. While you can build your body to conquer life, you also have to build your mind. You have to take some leaps of faith without a protective rope:

You also have to rely on the people you care about. If you need help like I did, contact Jackson or anyone you know that can help you with this kind of thing.

FEAR only has one meaning to me now. Face Everything And Rise.

~DS